Eitc calculator 2021

Have a valid Individual Taxpayer Identification Number During 2021 lived in the US. The earned income tax credit is available to claim for the 2021 2022 tax seasonHowever the IRS estimates that about 15 of eligible individuals do not claim this tax credit.

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income.

. Basic Qualifying Rules. Investment income includes interest income including tax-exempt interest dividends net rent net capital gains and net passive income. Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season.

Provide the following information and. Ad Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

There are three main eligibility requirements to claim the EITC. EITC Tables Use these table organized by tax year to find the maximum amounts for. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

When done with the EITC Calculator use the 2021 Tax Return Estimator to calculate and prepare your taxes. If you elected to use your 2019 earned income in calculating your 2021 federal earned income credit you must also use your 2019. However most people wont be able to claim the full.

In some cases the EIC can. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Have investment income below 10000 in the tax year 2021.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The amount of your NJEITC is a percentage of your federal Earned Income Tax Credit. Have worked and earned income under 57414. Adjusted gross income AGI Investment income you can make Credit amount you can.

This can be from wages salary tips employer-based disability self-employment. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Earned income credit New York State Important for 2021. You can use the Earned Income Dependents Tax Credit Calculator to see how much of a credit you qualify for. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. If you qualify you can use the credit to reduce the taxes you owe. You can also use all the other 2021 tax calculators before loading up the free.

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021. Election to use prior-year earned income. Once you have your estimated amount for the EITC you are then able to use.

Answer some questions to see if you. Help with investment income. Earned Income Tax Credit Calculator - EIC Earned Income Tax Credit EIC Calculator Earned Income Credit EIC is a tax credit available to low income earners.

The maximum amount you can get from this credit is 6728 for the 2021 tax year which is a moderate increase from 2020. Earned Income Tax Credit EITC Assistant. For 2021 the NJEITC amount is 40 of the federal credit amount.

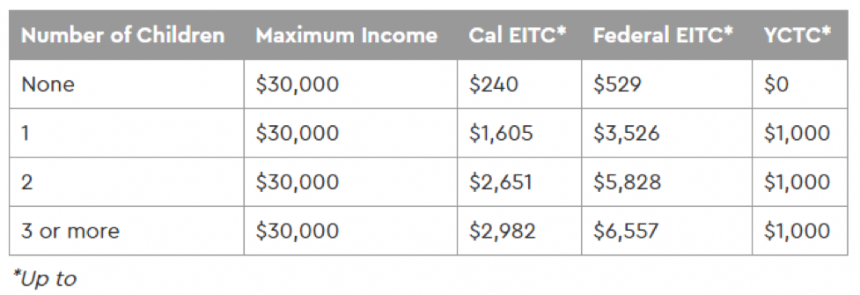

What is the Earned. The average amount of EITC received nationwide was 2411. More than 6 months Also lived in California more than 6 months in 2021 Are at least 18 years old Cannot be.

If you are eligible for EITC If you meet the tests for claiming qualifying. The EIC calculator otherwise known as the EITC Assistant is a tool supplied by the IRS that allows you to find out. Nationwide as of December 2021 approximately 25 million taxpayers received over 60 billion in EITC.

The EITC Assistant. To qualify for the EITC you must. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status.

The first is that you work and earn income.

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Summary Of Eitc Letters Notices H R Block

Earned Income Credit Eic

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

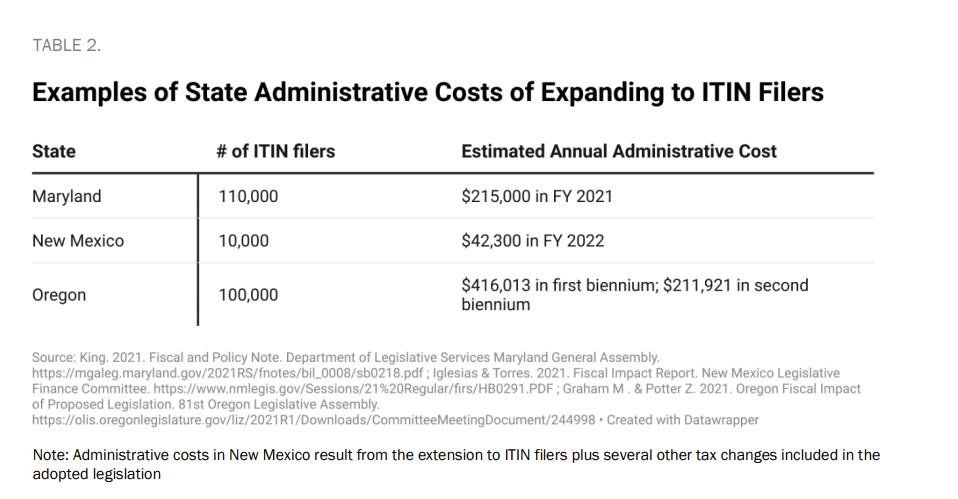

North Carolina S Policymakers Should Carefully Consider Not Just Whether To Adopt An Eitc But How To Structure It Unc Tax Center

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

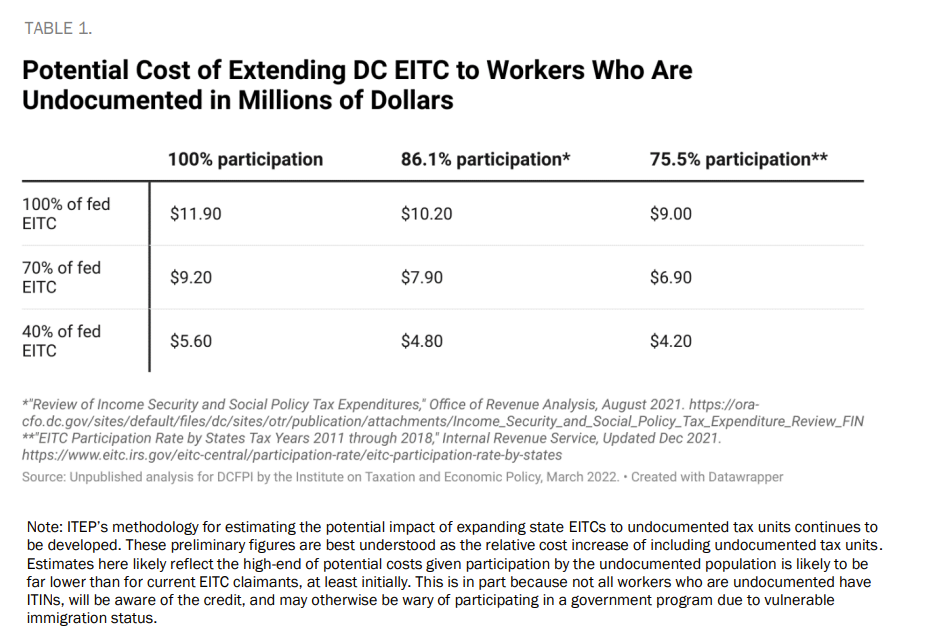

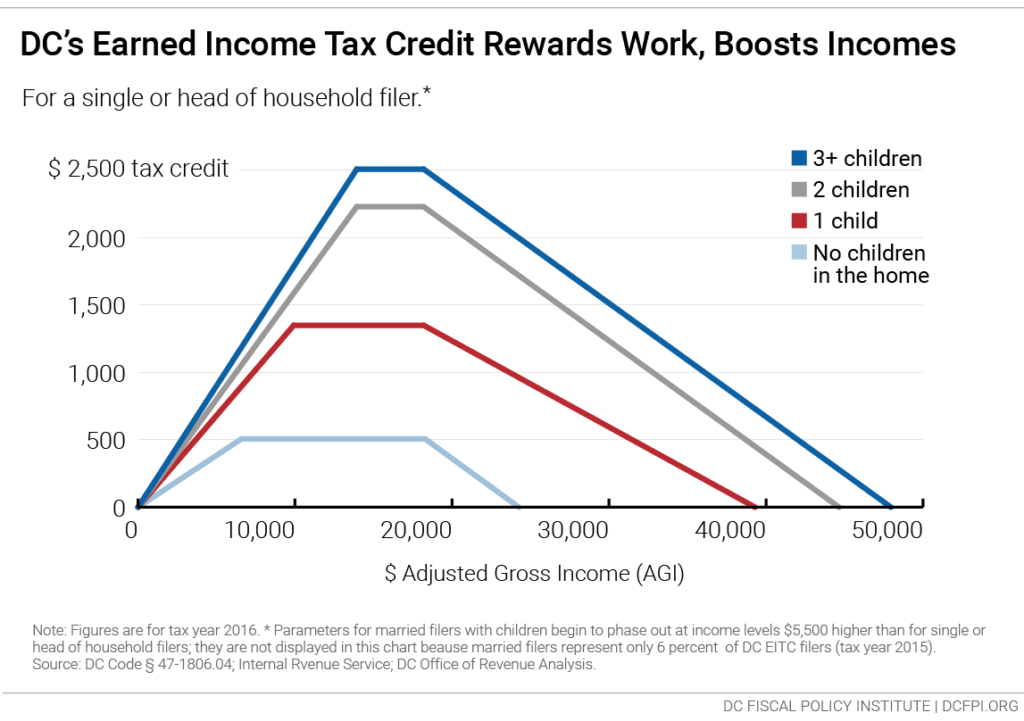

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

More Than Just A Refund Eitc Helps Lift People From Poverty The Center For Community Solutions

Earned Income Tax Credit

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Dc S Earned Income Tax Credit

Earned Income Credit Eic Table 2020 2021 Free Tax Filing Tax Time Tax Refund

Refundable Tax Credits

Claim Your 2018 Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Earned Income Tax Credit Eitc Tax Preparation 2020 Youtube